Public Provident Fund Calculator: Mastering Financial Planning

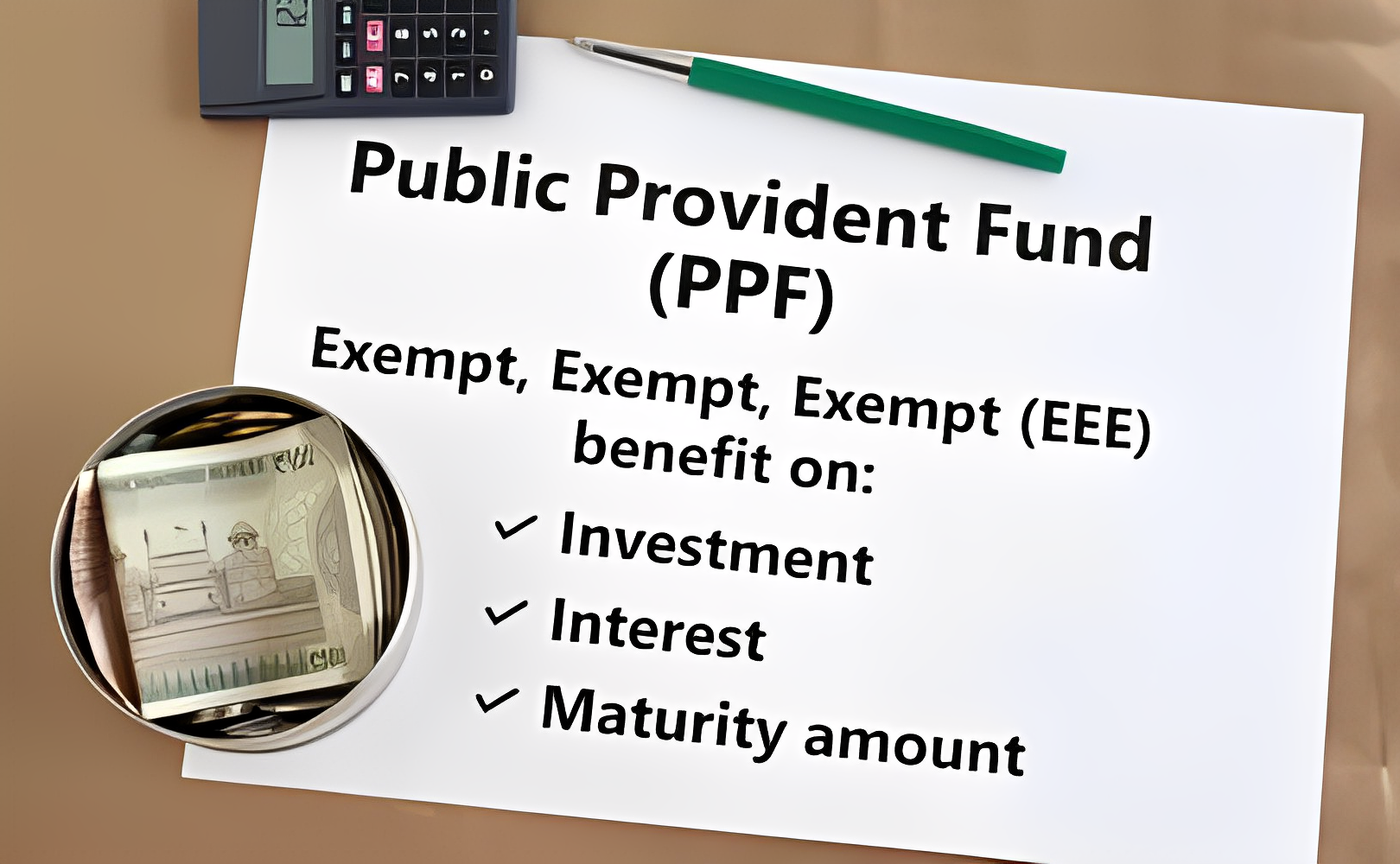

The Public Provident Fund (PPF) has been a cornerstone of financial planning in India for decades. Its attractive interest rates, tax-free benefits, and long-term lock-in period make it an ideal tool for accumulating wealth and securing retirement. But navigating the intricacies of PPF investments can be daunting, especially when it comes to understanding how much to contribute to reach your financial goals. This is where the PPF calculator steps in as your financial planning superhero.

Demystifying the Public Provident Fund PPF Calculator: Your Personalized Roadmap to Wealth

A PPF calculator is a digital tool that helps you estimate your future corpus based on your investment amount, tenure, and interest rates. It empowers you to:

- Plan your contributions: By factoring in your desired retirement corpus and investment horizon, the calculator suggests the monthly/annual contribution amount needed to achieve your goal.

- Compare investment scenarios: Analyze the impact of different contribution amounts and interest rates on your final Public Provident Fund

- Track your progress: Monitor your progress towards your financial goals and adjust your investments if needed.

Using a PPF calculator is straightforward. Simply enter your desired retirement corpus, investment period, and current age. The calculator will then estimate your required monthly/annual contributions and project your future Public Provident Fund PPF balance at maturity. Some advanced calculators even allow you to factor in inflation and tax benefits for a more comprehensive picture.

While the Public Provident Fund calculator is a valuable tool, it’s crucial to remember that financial planning is not just about crunching numbers. Here are some additional tips to make the most of your Public Provident Fund investments:

- Start early: The earlier you start investing in PPF, the more time your money has to grow through compounding interest. Ideally, begin investing in your 20s or 30s to maximize the benefits.

- Maintain consistent contributions: Sticking to your chosen contribution schedule is key to achieving your desired corpus. Set up automatic transfers to avoid missed contributions and ensure disciplined investing.

- Utilize the full tenure: The Public Provident Fund has a lock-in period of 15 years, but you can extend it in blocks of 5 years to maximize returns. This allows your investments to benefit from compounding interest for a longer period.

- Seek professional advice: While the PPF calculator provides valuable insights, consulting a financial advisor can help you create a holistic financial plan that considers your individual circumstances and risk tolerance.

PPF vs. Other Investment Options: Finding the Right Fit

The Public Provident Fund is not the only tool in your financial planning toolbox. It’s important to compare it with other investment options like Equity Linked Savings Schemes (ELSS), National Pension Scheme (NPS), and mutual funds to find the best fit for your goals and risk appetite.

- ELSS: Offer higher potential returns than PPF but come with market volatility and inherent risks.

- NPS: Provides market-linked returns with tax benefits but has a longer lock-in period than PPF.

- Mutual funds: Offer a diverse range of investment options with varying risk profiles, but require active management and may incur higher fees.

Ultimately, the ideal investment strategy involves diversifying your portfolio across different asset classes to mitigate risk and optimize returns.

Consult a financial advisor to determine the right mix of investments for your unique needs.

The PPF has transcended its status as just a savings scheme – it’s a cornerstone of financial freedom in India. Its allure lies in the potent trifecta of attractive interest rates, tax-free benefits, and a long-term lock-in, making it a wealth-building powerhouse. But navigating the intricacies of Public Provident Fund investments can be like deciphering ancient runes. Fear not, for the PPF calculator emerges as your financial planning superhero, ready to demystify the path to prosperity.

Unveiling the PPF Calculator: Your Personalized Money Map

Imagine a crystal ball revealing your future PPF corpus, gleaming with compounded interest. That’s the magic of the Public Provident Fund calculator. This digital oracle empowers you to:

● Chart your contribution course: Plug in your desired retirement corpus and investment horizon, and the calculator spits out the magic number – the monthly/annual contribution you need to reach your goal.

● Compare investment constellations: Analyse the impact of varying contribution amounts and interest rates on your final PPF bounty. It’s like test-driving different investment scenarios before hitting the real road.

● Track your financial trek: Monitor your progress towards that dream retirement corpus. Like a fitness tracker for your finances, it nudges you to stay on course and adjust your investments if needed.

Using the PPF calculator is child’s play. Just enter your retirement aspirations, investment timeline, and current age. The calculator, in a flash, estimates your required monthly/annual contributions and paints a vivid picture of your future PPF nest egg at maturity. Advanced calculators add a dash of inflation and tax benefits, presenting an even more comprehensive financial forecast.

Beyond the Numbers: Mastering the Art of Public Provident Fund Planning

While the PPF calculator is your financial GPS, remember, financial planning is not a numbers game alone. Here’s how to make the most of your PPF voyage:

● Set sail early: The earlier you start investing, the more your money enjoys the magic of compounding interest. Think of it as planting a wealth seed in your 20s or 30s to reap a bountiful harvest later.

● Steady the ship: Consistency is key! Sticking to your chosen contribution schedule is like having a loyal financial first mate. Automate your contributions to avoid missed investments and ensure smooth sailing.

● Extend the voyage: The PPF’s 15-year lock-in is just the minimum. You can extend it in 5-year increments, letting your investments bask in the sunshine of compounding interest for an even longer period.

● Seek expert guidance: The PPF calculator provides valuable navigational tools, but a seasoned financial advisor can chart a holistic financial course, considering your individual circumstances and risk tolerance. Think of them as your financial captain, guiding you through uncharted waters.

PPF vs. The Investment Ocean: Finding Your Perfect Harbor

The PPF is not the only ship in the vast investment ocean. Let’s explore other options and find the one that fits your financial map:

● Equity Linked Savings Schemes (ELSS): These offer potentially higher returns than PPF, but come with the thrill (and peril) of market volatility. Think of them as speedboats – exciting, but requiring a steady hand.

● National Pension Scheme (NPS): This market-linked option provides tax benefits but has a longer lock-in period than PPF. It’s like a sturdy cargo ship – slow and steady, but offering long-term stability.

● Mutual funds: This diverse armada offers a plethora of investment options with varying risk profiles. But navigating this open sea requires active management and may incur higher fees. Think of them as yachts – luxurious, but demanding constant attention.

Remember, the ideal investment strategy is like building a balanced fleet. Diversify your portfolio across different asset classes to spread the risk and optimize returns. Consult your financial advisor to assemble the perfect fleet for your unique financial voyage.

The PPF Calculator: Your Key to Unlocking Financial Freedom

The PPF calculator is not just a number cruncher; it’s a gateway to financial freedom. By understanding its power and incorporating its insights into your investment strategy, you can harness the PPF’s magic to achieve your long-term financial goals and build a secure and prosperous future. Remember, financial planning is a marathon, not a sprint. Use the PPF calculator as your trusty companion, stay disciplined, and make informed investment decisions to unlock the door to your financial dreams.

So, set your sails, leverage the PPF calculator’s wisdom, and embark on your journey to financial freedom!

Conclusion: The PPF Calculator – Your Key to Financial Freedom

The PPF calculator is a powerful tool that can empower you to take control of your financial future. By understanding how it works and incorporating its insights into your investment strategy, you can leverage the PPF’s benefits to achieve your long-term financial goals and secure a comfortable retirement. Remember, financial planning is a journey, not a destination. Use the PPF calculator as your guide, stay disciplined, and make informed investment decisions to unlock your financial freedom.

Sources:

- Public Provident Fund (PPF) Scheme: https://www.nsiindia.gov.in/InternalPage.aspx?Id_Pk=55

- PPF Calculator by Paisabazaar: https://www.paisabazaar.com/saving-schemes/ppf-calculator/

- Financial Planning Tips for Indians: https://www.tataaia.com/blogs/financial-planning/top-7-tips-for-financial-planning-in-india.html

Pre-Leased Property for Sale: Unlocking Opportunities in Pre-Leased Real Estate 2024

PPF Calculator: Optimising Investments with Public Provident Fund Calculations