Introduction | ELSS Mutual Funds

Looking to invest in India’s top Equity Linked Savings Schemes (ELSS) Mutual Funds in 2024? Get ready to explore the top-performing funds that offer the dual benefit of tax-saving and wealth creation. Whether you’re a new investor or seasoned player in the market, making informed decisions about ELSS funds is crucial. In this blog, we’ll dive into the best ELSS mutual funds in India, analyzing their performance, tax-saving potential, and overall suitability for your investment goals. Let’s navigate through the exciting world of ELSS and discover the most promising options for the year ahead.

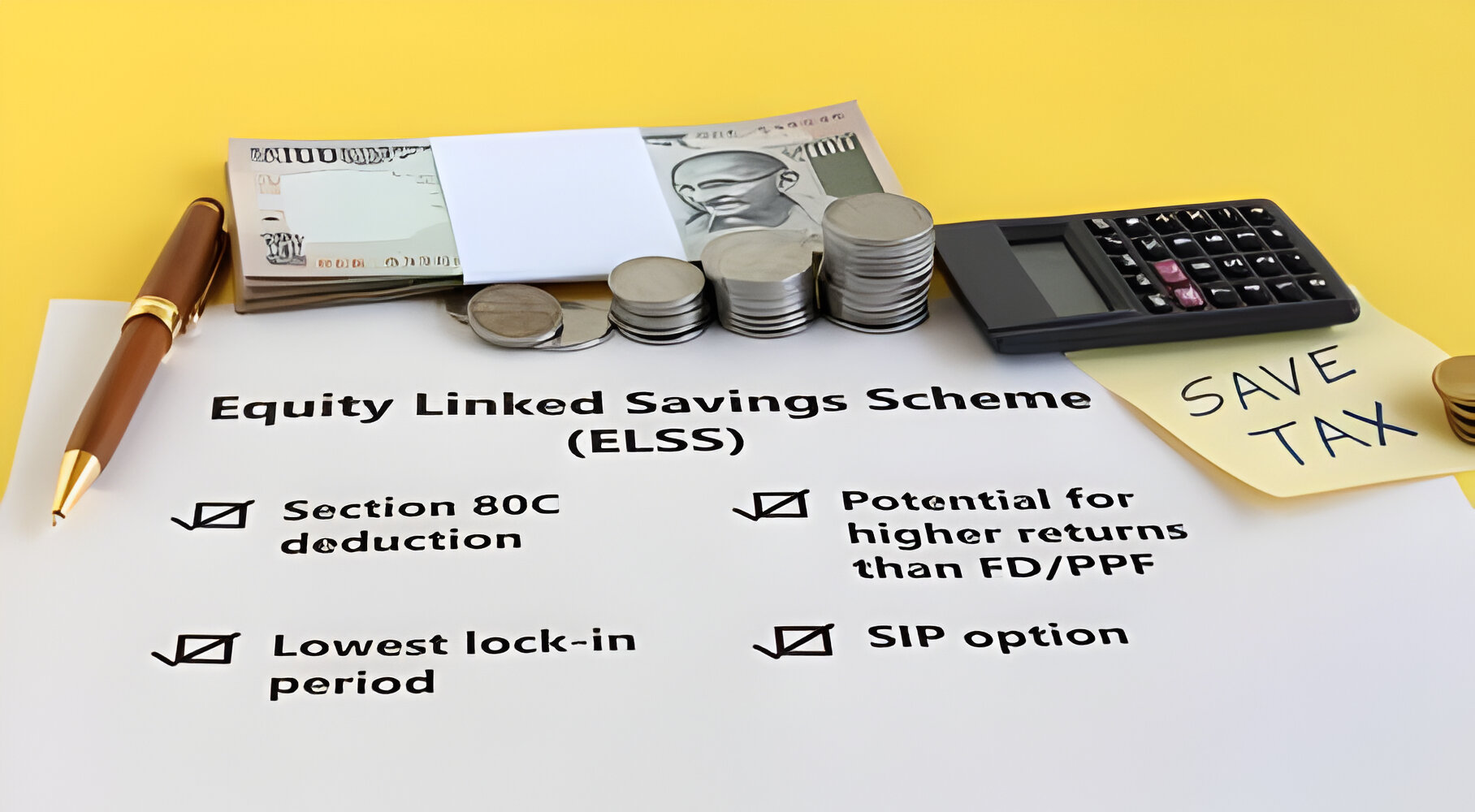

The Benefits of Investing in ELSS Funds in India

India’s Top ELSS Mutual Funds for Investment in 2024 ELSS funds, known for their tax-saving benefits under Section 80C of the Income Tax Act, have become a go-to option for many investors. With their focus on the Indian equity market, investing in ELSS funds presents an exciting opportunity to tap into the country’s growth potential. One of the key advantages of these funds is their remarkably short lock-in period of just three years, which sets them apart from other tax-saving investment alternatives. Furthermore, the appeal of ELSS funds lies in their ability to deliver both tax savings and wealth creation, making them an appealing choice for individuals with long-term financial aspirations.

What to Consider When Choosing ELSS Mutual Funds for Investment

When considering ELSS mutual funds for investment in 2024, it’s essential to look at the historical performance of the fund, especially during market downturns. Look for funds with a consistent track record of strong returns over a period of 5-10 years, as this reflects the fund’s ability to weather different market conditions. Additionally, assessing the fund manager’s experience and expertise in managing ELSS funds can provide valuable insights into the potential future performance of the fund. Finally, evaluating the fund’s expense ratio and comparing it with similar funds in the category can help in making an informed investment decision. By carefully analyzing these factors, investors can have a comprehensive understanding of the potential of ELSS funds for their portfolio in 2024.

A Comparison of the Top ELSS Mutual Funds in India for 2024

Investing in ELSS mutual funds not only offers tax benefits under Section 80C of the Income Tax Act but also presents an appealing opportunity for long-term wealth creation. Top ELSS funds like Axis Long Term Equity Fund and Aditya Birla Sun Life Tax Relief 96 have consistently outperformed their benchmark indices, demonstrating their ability to provide strong returns to investors. When comparing ELSS funds, it’s crucial to consider various factors such as fund performance, expense ratio, fund manager experience, and the fund’s investment philosophy. Additionally, investors should carefully assess their risk tolerance and investment goals to ensure that the chosen ELSS fund aligns with their financial objectives and time horizon.

How ELSS Mutual Funds Can Help You Save Tax and Build Wealth

Investing in ELSS mutual funds can be a strategic way to save on taxes while aiming for long-term wealth accumulation. The three-year lock-in period promotes consistent and disciplined investing, allowing your investment to mature over time. Additionally, the diversified portfolio of equities in ELSS funds presents the potential for capital growth alongside tax benefits, making it a compelling option for individuals with a long-term investment horizon.

Tips for Making Informed Decisions When Investing in ELSS Funds

When evaluating ELSS mutual funds for investment, it’s crucial to consider the fund’s historical performance and consistency to gauge its reliability. Additionally, looking into the fund manager’s experience and track record in managing ELSS funds can provide valuable insights into the potential future performance of the fund. Assessing the fund’s expense ratio is equally important, as it helps in understanding the impact on returns over time. Moreover, understanding the lock-in period of the ELSS fund is essential to ensure it aligns with your investment goals and liquidity needs, providing a comprehensive understanding of the potential of ELSS funds for your portfolio in 2024.

Why should you consider investing in ELSS funds in 2024?

In 2024, investing in ELSS funds could prove to be a smart financial move, offering tax benefits under Section 80C of the Income Tax Act while presenting an opportunity to tap into the growth potential of the Indian equity market. With a remarkably short lock-in period of just three years, ELSS funds also provide more liquidity compared to alternative tax-saving instruments like PPF and NSC. As the year unfolds, the expected economic growth and market performance further enhance the appeal of ELSS funds, making them a potential avenue for favorable returns.

Key factors to consider when choosing ELSS mutual funds for investment

When considering ELSS funds for investment, it’s important to assess the fund’s performance over the last 3-5 years to gauge its consistency and growth potential. Look for a fund with a low expense ratio, as this can maximize your returns over time. Evaluating the fund manager’s experience and track record in managing ELSS funds provides valuable insights into their expertise. Additionally, assessing the tax-saving benefits offered by the ELSS fund can optimize your investment strategy and overall financial planning.

Top-performing ELSS mutual funds in India for 2024

Investing in ELSS mutual funds offers the advantage of potential tax benefits under Section 80C of the Income Tax Act. SBI Tax Advantage Fund focuses on long-term capital appreciation through investments in equity and equity-related securities. With a consistent track record of delivering favorable returns, Aditya Birla Sun Life Tax Relief 96 has been a reliable choice for investors. Similarly, Axis Long Term Equity Fund has gained popularity due to its disciplined investment approach, making it a sought-after option for investors looking for tax-saving opportunities. These funds represent compelling choices for individuals aiming to save on taxes while pursuing long-term wealth accumulation through equity investments.

Tips for maximizing returns with ELSS mutual funds investments

Considering investing in top-rated ELSS mutual funds can be a strategic approach to maximizing returns and availing tax benefits. It’s essential to regularly review the performance of your ELSS mutual funds to ensure they are in line with your financial goals. Additionally, utilizing the power of compounding by staying invested in ELSS mutual funds for the long term can potentially lead to significant wealth accumulation. Exploring the option of systematic investment plans (SIPs) is another valuable strategy to benefit from rupee cost averaging and mitigate market volatility. These approaches can contribute to a well-rounded investment plan while aiming for tax savings and long-term wealth creation through ELSS mutual funds.

The Benefits of Investing in ELSS Funds

Investing in ELSS funds presents a compelling opportunity for individuals seeking to save on taxes, as they offer tax benefits under Section 80C of the Income Tax Act. Moreover, these funds have the potential to facilitate wealth creation over the long term, given their exposure to equity markets and the possibility of higher returns compared to traditional options. With a remarkably short lock-in period of just three years, ELSS funds provide investors with liquidity and flexibility, setting them apart from other tax-saving investment avenues. Additionally, the professional management of these funds by experienced fund managers is designed to deliver optimal returns, making them a favorable choice for investors looking to maximize their investment potential.

How to strategically allocate your investments in ELSS funds

When evaluating ELSS mutual funds for investment, it’s crucial to consider the fund’s performance over the past 5-10 years to gauge its consistency and growth potential. Diversifying your investments across multiple top ELSS mutual funds can help spread risk and maximize potential returns. Additionally, evaluating the fund manager’s experience and track record in managing ELSS funds is key for informed decision-making. It’s equally important to keep an eye on the expense ratio of the funds to ensure cost-effectiveness and higher net returns, ultimately contributing to a well-rounded investment strategy.

Frequently Asked Questions

Conclusion

In conclusion, investing in ELSS funds in India for 2024 offers a plethora of benefits, including tax savings under Section 80C of the Income Tax Act and the potential for long-term wealth creation through exposure to equity markets. When choosing ELSS mutual funds, it’s crucial to consider factors such as the fund’s performance over the past decade, the experience of the fund manager, and the expense ratio. The top-performing ELSS mutual funds for 2024, such as SBI Tax Advantage Fund, Aditya Birla Sun Life Tax Relief 96, and Axis Long Term Equity Fund, present compelling opportunities for tax-saving and long-term wealth accumulation. By strategically allocating investments across multiple top ELSS mutual funds and utilizing the power of compounding through systematic investment plans, investors can maximize returns and mitigate market volatility, contributing to a well-rounded investment strategy while aiming for tax savings and long-term wealth creation.

SEBI Registered Investment Advisors | start investing | Plot in Rishikesh