India EPF Passbook : Navigating Provident Fund Transaction Records Digitally

The Employees’ Provident Fund Organisation (EPFO) of India plays a crucial role in securing the financial future of millions of salaried individuals. A key element of this system is the EPF passbook, a digital document that provides account holders with a comprehensive view of their provident fund contributions and accumulations.

In the past, accessing and understanding EPF records could be a cumbersome process, often requiring visits to physical EPFO offices and deciphering complex statements. However, the introduction of the online EPF passbook has revolutionized the way account holders manage their provident funds. This article delves into the intricacies of the India EPF passbook, guiding readers through its features, functionalities, and benefits.

Demystifying the India EPF Passbook: Key Features and Functionalities

The online EPF passbook is a secure and convenient platform accessible through the EPFO member portal (https://unifiedportal-mem.epfindia.gov.in/). Once logged in, members can access their passbooks, which display a wealth of information, including:

Member details: This section provides basic information like name, date of birth, and Universal Account Number (UAN).

Account balance: The passbook clearly displays the current balance in the employee’s provident fund account, broken down into contributions made by the employee and employer.

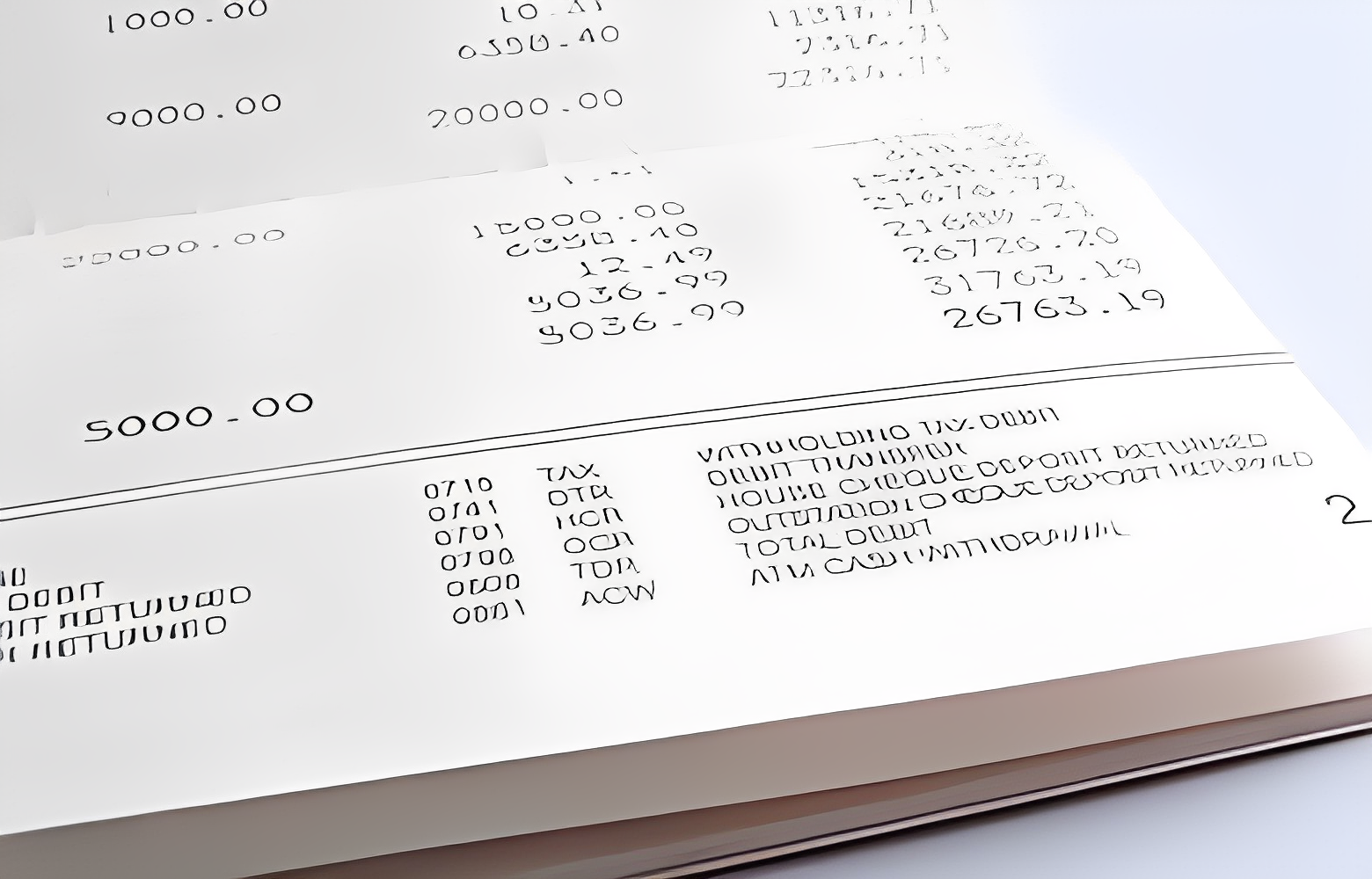

Transaction history: This section chronologically lists all transactions made to the account, including contributions, withdrawals, and interest earned. Each transaction is accompanied by details like date, amount, and purpose.

Nominations: The passbook allows members to view and manage their nominee details, ensuring the smooth transfer of accumulated funds in case of unforeseen circumstances.

Service details: This section provides information about the member’s employment history, including employer details and service periods for each job.

The online EPF passbook also offers various functionalities that enhance user experience and simplify provident fund management. These include:

Download passbook: Members can download their passbook in PDF format for offline reference or record keeping.

Mini statement: A mini statement option provides a concise summary of recent transactions for quick reference.

UAN activation: The passbook facilitates UAN activation, a crucial step for linking all provident fund accounts under one umbrella.

Claim submission: Members can initiate online claims for various purposes like withdrawal, maturity, or transfer of funds.

Benefits of Using the India EPF Passbook

The online EPF passbook offers a multitude of benefits for account holders, making it an indispensable tool for managing provident funds effectively. Some key advantages include:

Enhanced transparency: The passbook provides real-time access to detailed account information, fostering transparency and accountability in provident fund management.

Convenience and accessibility: The online platform eliminates the need for physical visits to EPFO offices, saving time and effort. Members can access their passbooks from anywhere with an internet connection.

Improved record keeping: The downloadable passbook format allows for easy record keeping and future reference.

Reduced paperwork: The online system minimizes the need for physical documents and claim forms, streamlining the provident fund management process.

Empowerment and informed decision-making: Access to detailed transaction history and account balance empowers members to make informed decisions regarding their provident funds, such as planning for retirement or utilizing available withdrawal options.

Understanding the Key Features and Functionalities:

Member Details:

The EPF passbook provides a comprehensive overview of member details, including essential information such as name, date of birth, and the Universal Account Number (UAN).

Account Balance:

Users can easily view their current provident fund account balance, with a detailed breakdown of contributions made by both the employee and the employer.

Transaction History:

A chronological list of all transactions related to the account, including contributions, withdrawals, and interest earned, is presented. Each entry includes crucial details such as the date, amount, and purpose of the transaction.

Nominations:

The passbook allows members to manage their nominee details, ensuring a smooth transfer of accumulated funds in the event of unforeseen circumstances.

Service Details:

This section offers insights into the member’s employment history, including employer details and service periods for each job.

Enhancing User Experience:

Download Passbook:

Members have the option to download their passbook in PDF format, facilitating offline reference or record-keeping.

Mini Statement:

A mini statement feature provides a concise summary of recent transactions, allowing for quick reference and overview.

UAN Activation:

The passbook facilitates UAN activation, a crucial step in linking all provident fund accounts under one umbrella for comprehensive management.

Claim Submission:

Users can initiate online claims for purposes such as withdrawal, maturity, or the transfer of funds, streamlining the entire process.

Conclusion: A Gateway to Financial Security

The India EPF passbook is a game-changer in provident fund management, offering unparalleled convenience, transparency, and control to account holders. By leveraging its features and functionalities, members can actively monitor their provident fund accounts, make informed decisions, and ultimately secure their financial future. With its emphasis on digital access and user empowerment, the online EPF passbook is a testament to the EPFO’s commitment to improving the lives of millions of Indian workers.

Sources:

- Employees’ Provident Fund Organisation website: https://unifiedportal-mem.epfindia.gov.in/

- Ministry of Labour and Employment website: https://labour.gov.in/