Public Provident Fund Calculator: Navigating PPF Investments

In the labyrinthine world of Indian financial instruments, the Public Provident Fund (PPF) shines as a beacon of stability and growth. For years, it has been the go-to choice for risk-averse investors seeking long-term wealth creation with guaranteed returns. But navigating the intricacies of PPF investments can be daunting, especially for those unfamiliar with financial calculations. This is where the Public Provident Fund calculator comes into play, acting as your trusty map and compass on the path to financial security.

Understanding the Power of the Public Provident Fund Calculator

A Public Provident Fund calculator is a web-based tool that helps you estimate your future corpus based on your investment amount, tenure, and current interest rate. It simplifies complex calculations, empowering you to make informed decisions about your PPF contributions. Here’s how it works:

- Input your desired investment amount: This could be your monthly or annual contribution, depending on your preference and budget.

- Choose your investment tenure: The PPF lock-in period is 15 years, but you can extend it in blocks of 5 years thereafter.

- Enter the current interest rate: The PPF interest rate is revised quarterly by the government.

- Hit calculate: Within seconds, the calculator displays your projected maturity amount, along with the annual interest earned.

Benefits of Using a PPF Calculator:

The advantages of using a PPF calculator extend far beyond mere number crunching. Here are some key benefits:

- Informed investment decisions: The calculator helps you visualize the impact of different investment amounts and tenures, allowing you to tailor your contributions to your financial goals.

- Retirement planning: By estimating your future corpus, you can gauge your financial preparedness for retirement and adjust your savings accordingly.

- Goal-oriented investing: Whether you’re saving for your child’s education, a dream home, or a comfortable retirement, the calculator helps you determine the contributions needed to achieve your specific goals.

- Reduced risk of over/underinvestment: By understanding your potential returns, you can avoid overinvesting and straining your budget or underinvesting and falling short of your goals.

Beyond the Numbers: Making the Most of your Public Provident Fund Investment

While the PPF calculator is a valuable tool, it’s crucial to remember that it’s just one piece of the puzzle. To maximize your Public Provident Fund returns, consider these additional factors:

- Start early: The longer your investment horizon, the greater the power of compounding interest. Starting early allows you to benefit from this snowball effect, significantly boosting your final corpus.

- Maintain regular contributions: Consistency is key in achieving your Public Provident Fund goals. Aim for regular monthly contributions to avoid lapsing and potential penalties.

- Utilize the extension option: Upon completing the initial 15-year lock-in period, you can extend your Public Provident Fund in 5-year blocks. This is a valuable option to continue earning tax-free interest and grow your corpus further.

- Seek professional guidance: If you have complex financial goals or require personalized advice, consulting a financial advisor can be beneficial. They can help you navigate the nuances of PPF investments and create a comprehensive financial plan aligned with your needs.

Beyond Basics: Advanced Calculations and Scenarios:

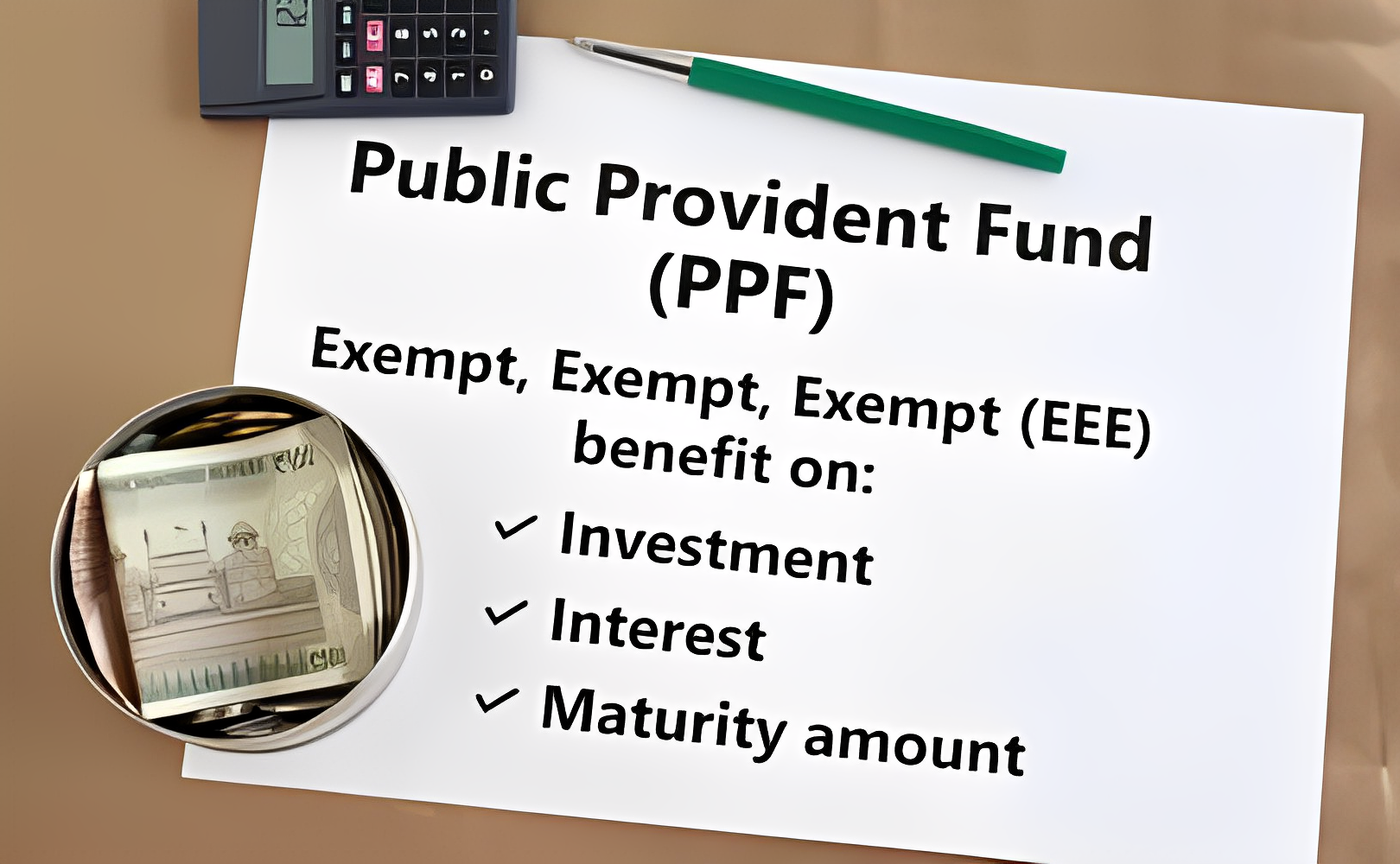

- Factor in tax benefits: Highlight the tax-exempt nature of PPF contributions, interest earned, and maturity amount. Include a tax calculator option to showcase the real net gains compared to taxable investments.

- Explore partial withdrawals: Explain the rules and implications of partial withdrawals after five years, allowing users to estimate their remaining corpus after such withdrawals.

- Compare with other instruments: Provide a side-by-side comparison of Public Provident Fund with other fixed-income or long-term investment options based on risk, returns, and liquidity.

- Scenario planning: Offer different investment scenarios based on age, income, and financial goals, demonstrating how the calculator can tailor contributions for specific needs.

Beyond Numbers: Practical Tips and Strategies:

- Optimizing contributions: Guide users on maximizing their contributions within the annual limit, including utilizing lump sum deposits or monthly investments.

- Loan facility: Explain the Public Provident Fund loan facility, its terms, and how it can be used without impacting investments.

- Nomination and account management: Emphasize the importance of nominee registration and regular account tracking to ensure smooth handling and inheritance.

- Digital tools and resources: Mention government portals and mobile apps that simplify Public Provident Fund transactions and provide real-time account information.

Engaging Your Audience:

- Case studies: Include success stories of individuals who achieved their financial goals through Public Provident Fund investments, making the benefits tangible and relatable.

- FAQs and glossary: Address common concerns and explain key Public Provident Fund terms, ensuring comprehensive understanding for everyone.

- Interactive features: Consider gamification elements or progress trackers to motivate users and make planning fun.

- Personalized recommendations: Based on user input and goals, the calculator could offer personalized investment suggestions.

By incorporating these aspects, you can transform your PPF calculator into a comprehensive financial planning tool, empowering users to make informed decisions and navigate the path to wealth creation with confidence. Remember, the power of the PPF lies not just in numbers, but in its ability to provide stability, security, and a brighter financial future.

Conclusion:

The Public Provident Fund calculator is a powerful tool that empowers you to navigate your PPF investments with precision. By using it effectively and incorporating the additional tips mentioned above, you can harness the full potential of this secure and rewarding investment avenue. Remember, the key to successful PPF investing lies in starting early, contributing regularly, and making informed decisions. So, take charge of your financial future, grab your calculator, and embark on a journey towards a secure and prosperous tomorrow.

Sources:

- Public Provident Fund Scheme Guidelines: https://www.paisabazaar.com/saving-schemes/ppf-interest-rates/

- PPF Calculator by Paisabazaar: https://www.paisabazaar.com/saving-schemes/ppf-calculator/

- Advantages and Disadvantages of Investing in PPF: https://cleartax.in/s/ppf

Public Provident Fund (PPF) Calculator: Mastering Financial Planning with PPF 24

PPF Calculator: Optimising Investments with Public Provident Fund Calculations